What Is The Point Of Laundering Money

The concept of cash laundering is very important to be understood for those working within the financial sector. It is a process by which soiled money is converted into clear money. The sources of the cash in precise are legal and the money is invested in a method that makes it appear to be clean money and conceal the identity of the criminal a part of the cash earned.

While executing the monetary transactions and establishing relationship with the new prospects or sustaining current prospects the responsibility of adopting enough measures lie on each one who is part of the group. The identification of such factor at first is simple to cope with as an alternative realizing and encountering such situations later on within the transaction stage. The central financial institution in any country provides full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

If your client or employer is unable to explain where a cash sum originated from or merely talks in circles its possible that he or she is trying to hide something. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

What Are Some Largely Used Money Laundering Methods Tookitaki Tookitaki

Money laundering is the act of disguising the original ownership identity and destination of the profits of a crime by hiding it within a legitimate financial institution and making it.

What is the point of laundering money. Money Laundering meaning in law. Money laundering reduces criminals Cost of crime thereby increasing the level of crime. Works of art have long been identified and sometimes even romanticized as ideal ways for racketeers to launder money.

Money Laundering is a separate offense which carries additional jail time. How Money Laundering Works In The Art World. Hiding the real owner of the illegally obtained money Reinjecting the funds back into the financial system so that it appears as though the funds came from a legal source.

Money laundering facilitatescorruption and crime. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct. 9 What Are The Benefits Of Money Laundering Laws.

In the real world money laundering is the act of cleaning large sums of illegal money ie making it seem as if the money has been obtained as the result of a legal sourceactivity. More specifically its the process of converting the profits of an illegal activity eg. Put together money laundering essentially means to washclean money.

But Office Space creator Mike Judges farcical setup does underscore an important point. The majority of global research focuses on two major money-laundering sectors. As money launderings entire point is to confuse where the money came from money launderers are typically very evasive regarding these types of questions.

Investment Actions that Make No Sense. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of the economy. The art world typically accommodates those that want to anonymously buy high-dollar paintings and on top of that the industry allows large cash.

Sometimes fund managers are. Drug trafficking and terrorist organizations. Lax anti- money-laundering policies encourage the criminal activities and corruption.

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Theres a thread of logic here. Allows for seizure and confiscation of proceeds of crime.

The main objectives for laundering money are as follows. Conceptually money laundering is pretty easy to understand. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today.

By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. Allows law enforcement access to bank and other financial institution records.

Understanding Money Laundering European Institute Of Management And Finance

What Are The Three Stages Of Money Laundering

Money Laundering In The 21st Century Follow The Money

What Is Money Laundering And How Is It Done

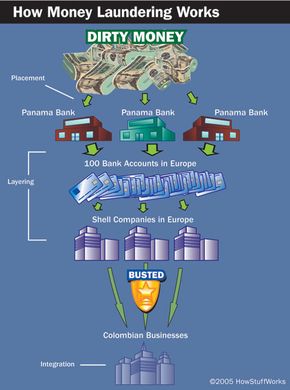

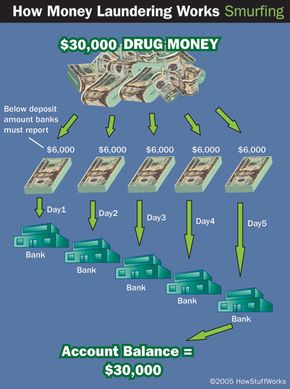

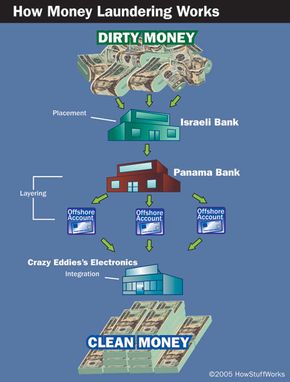

How Money Laundering Works Howstuffworks

Definition Stages And Methods Of Money Laundering Indiaforensic

Money Laundering Photos And Premium High Res Pictures Getty Images

How Money Laundering Works Howstuffworks

Money Laundering Overview How It Works Example

Money Laundering Eumcc Monetary Control Commission

How Money Laundering Works Howstuffworks

How Money Laundering Works Howstuffworks

Money Laundering Meaning And Definition Tookitaki Tookitaki

How Money Laundering Works Howstuffworks

The world of regulations can seem like a bowl of alphabet soup at instances. US cash laundering regulations are not any exception. Now we have compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting agency targeted on defending monetary providers by lowering danger, fraud and losses. Now we have massive bank expertise in operational and regulatory risk. Now we have a strong background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many antagonistic consequences to the group because of the risks it presents. It will increase the probability of major dangers and the opportunity price of the financial institution and ultimately causes the bank to face losses.

Komentar

Posting Komentar